In effort to increase healthcare transparency and empower consumers to make informed decisions, the Transparency in Coverage (TiC) rule was finalized in 2020 by the Depts of Health & Human Services, Labor, and the Treasury, requiring health plans to disclose negotiated prices for medical services, releasing Machine Readable Files (MRFs) for payments by procedure and provider beginning 7/1/22.

As hospital leaders in finance and managed care contracting wade into massively complex MRFs, what is readily apparent is the significant presence of “ghost providers” listed at “phantom prices”.

These are lines of data that look like the rest, but list providers for services they do not perform at prices they have not and will not be reimbursed at.

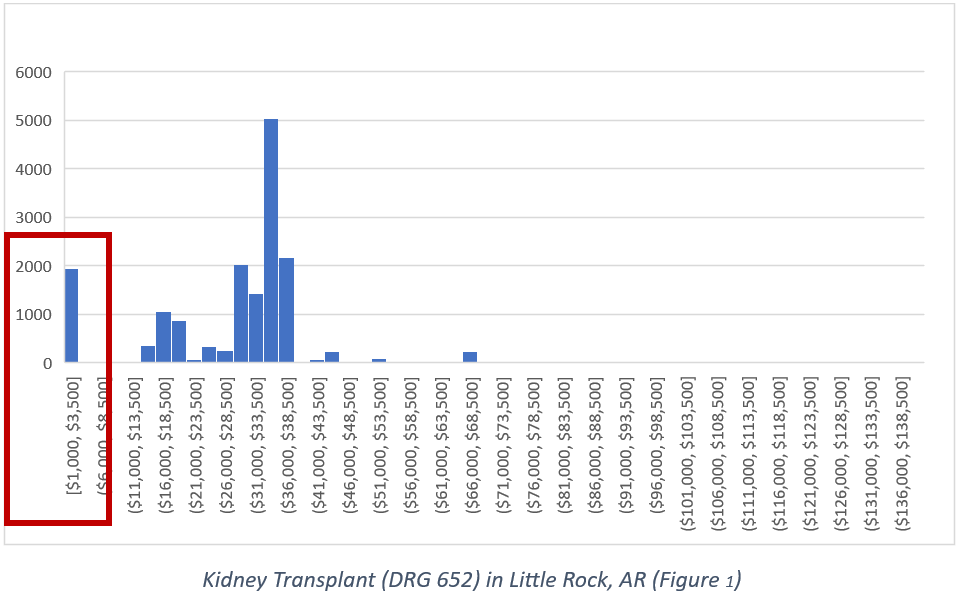

In other words, there’s more “trick” than treat. Perhaps if erroneous prices matched real rates, this would not be an issue. Unfortunately, they do not. Rather than finding a normal distribution for each procedure, commonly known as a ‘Bell Curve’, the ghost prices tend to cause a fat left tail.

These ghost rates, if not controlled for, make statistical projections of market averages, medians and percentiles appear lower than they really are.

This is particularly alarming for determining Qualifying Payment Amounts (QPAs) for out of network reimbursement, as evidenced by recent rulings in the Texas Medical Association’s suit challenging NSA on the presence of ghost rates. CMS defines QPA’s as the “median contracted rate”.

The recent Federal ruling states (page 43): “The Court holds that the following regulations are unlawful and must be set aside because they conflict with the No Surprises Act: (1) including in the calculation of QPAs contracted rates for services that providers have not provided…”

Present for both DRG and CPT, for Professional Service CPTs, the magnitude is most significant.

Lumbar Discectomy (63030)

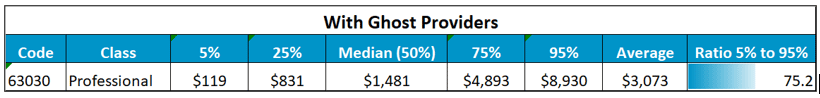

To maximize sample size, we’ll review TiC data across five major health plans in New York City (Aetna, Anthem, Cigna, Surest, UnitedHealthcare). Without excluding ghosts, revealed rates are as follows:

This suggests fair market reimbursement of about $1,500 – $3,000 (median to average). Now, how much of the statistics reflect reality?

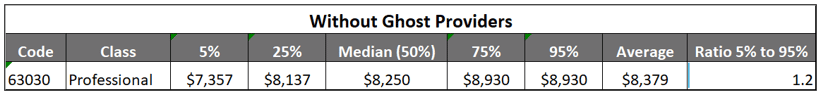

Turns out, very little. When we filter TiC data for prices using only providers that regularly perform and bill for discectomies, we get wildly different results:

The real story is reimbursement rates of about $7,000-$9,000.

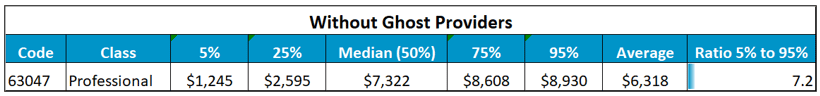

Interestingly, removing ghosts doesn’t typically drop variability that much, as for 63047 (laminectomy), even without ghosts we find a much wider range:

The first step in TiC analysis is to always remove trick from treat. There are several ways to do so. The most common is taxonomy codes, but this can still leave ghosts. For example, selecting for Orthopaedic Surgery doesn’t tell you which orthopods focus on backs vs knees vs shoulders. Second, it can also exclude real rates from other providers that register differently, for example, Sports Medicine.

To get to that specificity, utilization data is needed – what providers do and are being paid for at the code level. We do that here at DDI given our focus on physician quality, ranking physicians by what they do most and are good at (PRS), and healthcare pricing (HPG) with our transparency solutions.

For lumbar discectomy in NYC, that changes the median from $1,500 to $8,250. Wowzah.

Implications of Misleading TiC Data

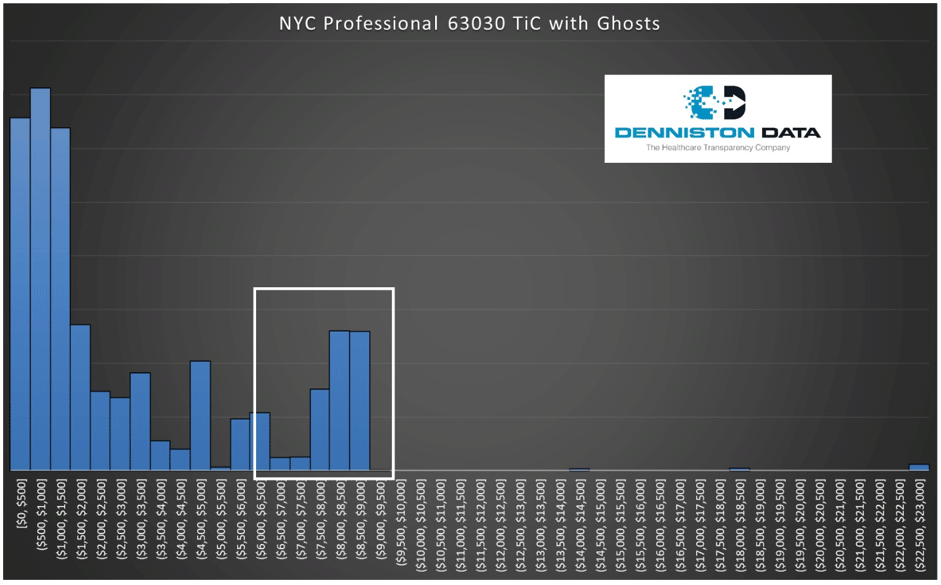

Given the difference in reported costs when cross-checked against utilization data, most of the prices in the TiC files are not “real”. For example, everything outside the white box was filtered as ghost rates:

The problem is not limited to NYC, as ghosts are also haunting Houston, Dallas, Austin, or El Paso. The biggest hole in the MRFs is they do not contain utilization data. How many times was the price paid to the listed provider for the service? If the provider doesn’t do the procedure, don’t trust the price.

This means hospital systems need their own process using another data source or a trusted data analytics partner who can ascertain what’s real from what’s not.

If your organization is negotiating, benchmarking, or settling on out-of-network QPAs using TiC files that have not been vetted against utilization, this phantom data will distort the pricing signals, creating a misleading picture of the actual costs associated with medical services.

That will cloud your decision-making and competitiveness, impairing the efficacy of the transparency initiative and its impact on the integrity of the healthcare system.

Conclusion

While the Transparency in Coverage Final Rule holds promise in revolutionizing the US healthcare landscape, the presence of ghost providers and inaccurate pricing threatens its effectiveness.

A threat, yes, but therein lies opportunity for those who can make sense of it. Stakeholders are rightly emboldened but must be cautious, vetting data sources to address this challenge, ensuring the transparency data reflects real utilization. Only through vigilant data-cleansing can the transparency initiative fulfill its intended purpose to empower decision-making and bring about positive change.

DDI will be hosting a Webinar in June (two dates to choose from) on this subject. As a Texas LLC catering to the hospital market, we would welcome THA members to join at no cost. Register today at https://zoom.us/webinar/register/2617152669021/WN_mQD3Lq6zSD6lN2okWiEDFg.

For more like this, join our email list at https://www.dennistondata.com/email-list-form/.

About the Author

Phil LeFevre is VP of Business Development at Denniston Data Inc (DDI), responsible for growing the footprint of DDI’s suite of transparency solutions around healthcare quality and price. Phil has over two decades of experience in healthcare analytics. Prior to joining DDI, Phil served as Managing Director for ODG and National VP for MCG Health, successfully managing the merger of ODG into MCG following acquisition by Hearst. MCG, part of the Hearst Health network, provides unbiased, evidence-based guidelines for payers and providers delivering patient-centered care. Phil joined ODG in 2000 after graduating from the University of Colorado with a B.A. in Economics.

This content is sponsored by Denniston Data.

Related articles from The Scope

Improving Hospital Executives’ Early Awareness of Data Breaches

Instead of focusing only on prevention before a breach and…

Overcoming Texas’ Post-Acute Care Challenges with Data

Texas health care providers are facing mounting pressures that threaten…

Do Hospitals Have Time for Data Breach Defense?

Hospitals face significant risks from data breaches that are exacerbated…

How Much Should I Save for Retirement

It might be the most common question asked by retirement…

Big Changes to Medicare Care Management in 2025

The 2025 Medicare Physician Fee Schedule Proposed Rule introduces several…

Navigating Texas Hospital Trends: Workforce, Costs, and Innovation

This article is sponsored by VativoRx, a leader in rebate…