The enhanced premium tax credits expired at the end of 2025. THA is urging Congress to reinstate this vital coverage support for Americans using the federal Health Insurance Marketplace. THA’s white paper, Keep Texans Insured: Renew the Enhanced Premium Tax Credits, details the dramatic impact of EPTC on Marketplace enrollment both in Texas and across the nation since the creation of EPTCs in 2021.

EPTCs offer expanded financial assistance and greater eligibility on top of the long-standing advance premium tax credits instituted in the Affordable Care Act more than a decade ago. With the credits expiring on Dec. 31, 2025, an estimated 4.2 million enrollees nationally – and around 1 million Texans – face the loss of their Marketplace coverage by 2034.

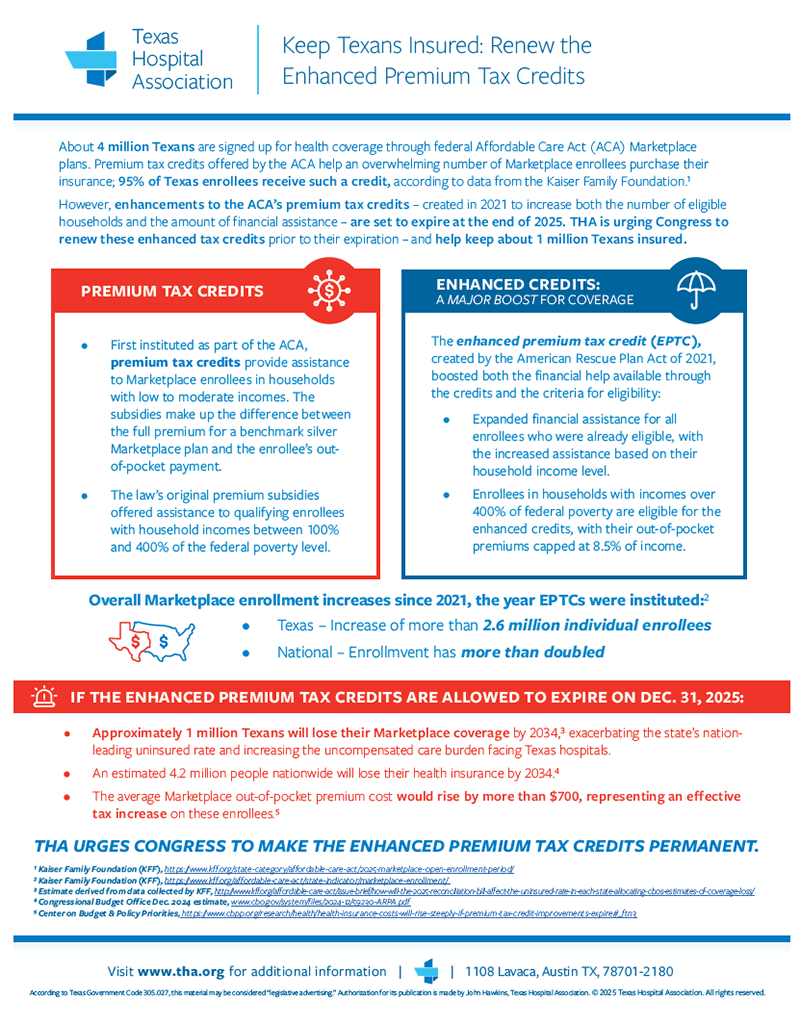

Keep Texans Insured: Renew the Enhanced Premium Tax Credits

About 4 million Texans are signed up for health coverage through federal Affordable Care Act (ACA) Marketplace plans. Premium tax credits offered by the ACA help an overwhelming number of Marketplace enrollees purchase their insurance; 95% of Texas enrollees receive such a credit, according to data from the Kaiser Family Foundation.¹

The enhancements to the ACA’s premium tax credits were created in 2021 to increase both the number of eligible households and the amount of financial assistance available. THA is urging Congress to renew these enhanced tax credits prior to their expiration and help Texans stay covered.

PREMIUM TAX CREDITS

- First instituted as part of the ACA, premium tax credits provide assistance to Marketplace enrollees in households with low to moderate incomes. The subsidies make up the difference between the full premium for a benchmark silver Marketplace plan and the enrollee’s out-of-pocket payment.

- The law’s original premium subsidies offered assistance to qualifying enrollees with household incomes between 100% and 400% of the federal poverty level.

ENHANCED CREDITS: A MAJOR BOOST FOR COVERAGE

The enhanced premium tax credit (EPTC), created by the American Rescue Plan Act of 2021, boosted both the financial help available through the credits and the criteria for eligibility:

- Enrollees in households with incomes over 400% of federal poverty are eligible for the enhanced credits, with their out-of-pocket premiums capped at 8.5% of income.

- Expanded financial assistance for all enrollees who were already eligible, with the increased assistance based on their household income level.

Overall Marketplace enrollment increases since 2021, the year EPTCs were instituted:²

- Texas – Increase of more than 2.6 million individual enrollees

- National – Enrollment has more than doubled

WITHOUT THE RENEWAL OF THE ENHANCED PREMIUM TAX CREDITS:

- Approximately 1 million Texans will lose their Marketplace coverage by 2034,³ exacerbating the state’s nationleading uninsured rate and increasing the uncompensated care burden facing Texas hospitals.

- An estimated 4.2 million people nationwide will lose their health insurance by 2034.⁴

- The average Marketplace out-of-pocket premium cost would rise by more than $700, representing an effective tax increase on these enrollees.⁵

THA URGES CONGRESS TO MAKE THE ENHANCED PREMIUM TAX CREDITS PERMANENT.

¹ Kaiser Family Foundation (KFF), https://www.kff.org/state-category/affordable-care-act/2025-marketplace-open-enrollment-period/

² Kaiser Family Foundation (KFF), https://www.kff.org/affordable-care-act/state-indicator/marketplace-enrollment/

³ Estimate derived from data collected by KFF, http://www.kff.org/affordable-care-act/issue-brief/how-will-the-2025-reconciliation-bill-affect-the-uninsured-rate-in-each-state-allocating-cbos-estimates-of-coverage-loss/

⁴ Congressional Budget Office Dec. 2024 estimate, https://www.cbo.gov/system/files/2024-12/59230-ARPA.pdf

⁵ Center on Budget & Policy Priorities, https://www.cbpp.org/research/health/health-insurance-costs-will-rise-steeply-if-premium-tax-credit-improvements-expire#_ftn3